"Supporting Mount Pisgah students and receiving a tax-credit really is a no-brainer."

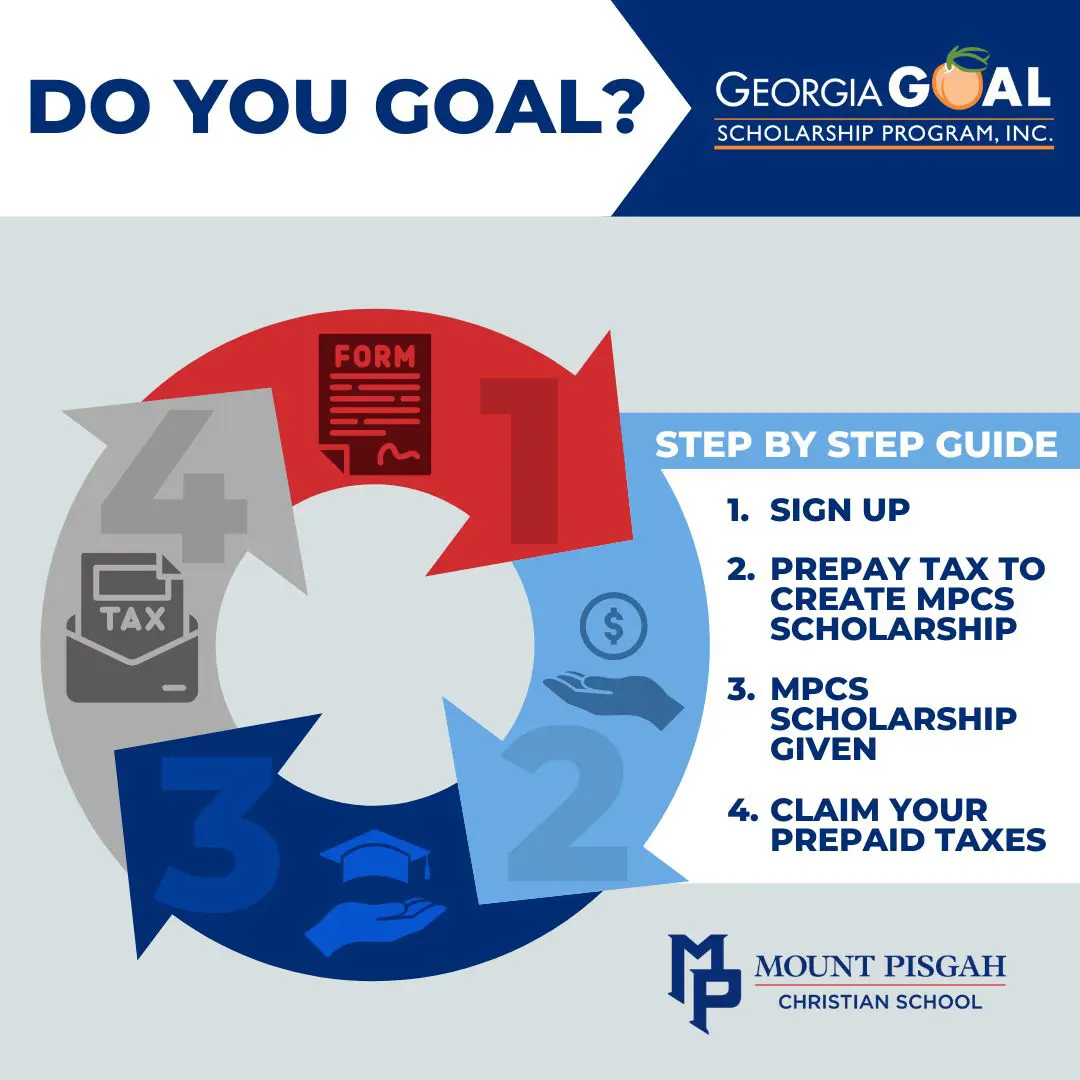

Georgia residents and businesses are allowed to direct a portion of their state taxes to Mount Pisgah to be used for scholarships through the Greater Opportunities for Access to Learning (GOAL).

Apply for Georgia GOAL tax credit (individual and joint filers) Business owners: claim your Georgia GOAL state tax credit

FREQUENTLY ASKED QUESTIONS

| WHAT IS THE IMPACT OF MY SUPPORT OF GEORGIA GOAL? |

|---|

By contributing to GOAL for a tax credit, you make it possible for Mount Pisgah to:

|

| HOW MUCH CAN I CONTRIBUTE? |

|

The amounts below are the maximums. It is not necessary to contribute the maximum amount to participate. Any amount benefits our students! Single: $2500 Please note, Georgia GOAL funds are not considered charitable contributions to the school. |

| HOW DO I SIGN UP? |

| Click here to complete the GOAL Online Paperless Process. Once you receive notification of your approval, simply click here to pay online or send a check payable to “Georgia GOAL Scholarship Program” in the amount of your contribution and mail to: Georgia GOAL 3740 Davinci Court, Suite 375 Peachtree Corners, GA 30092 GOAL will send you the required paperwork to claim the credit on your tax return. |

|

|

EMILY STEARNSManager, Georgia GOAL and Alumni Program |